Transaction Solution

Payment Switching Solutions

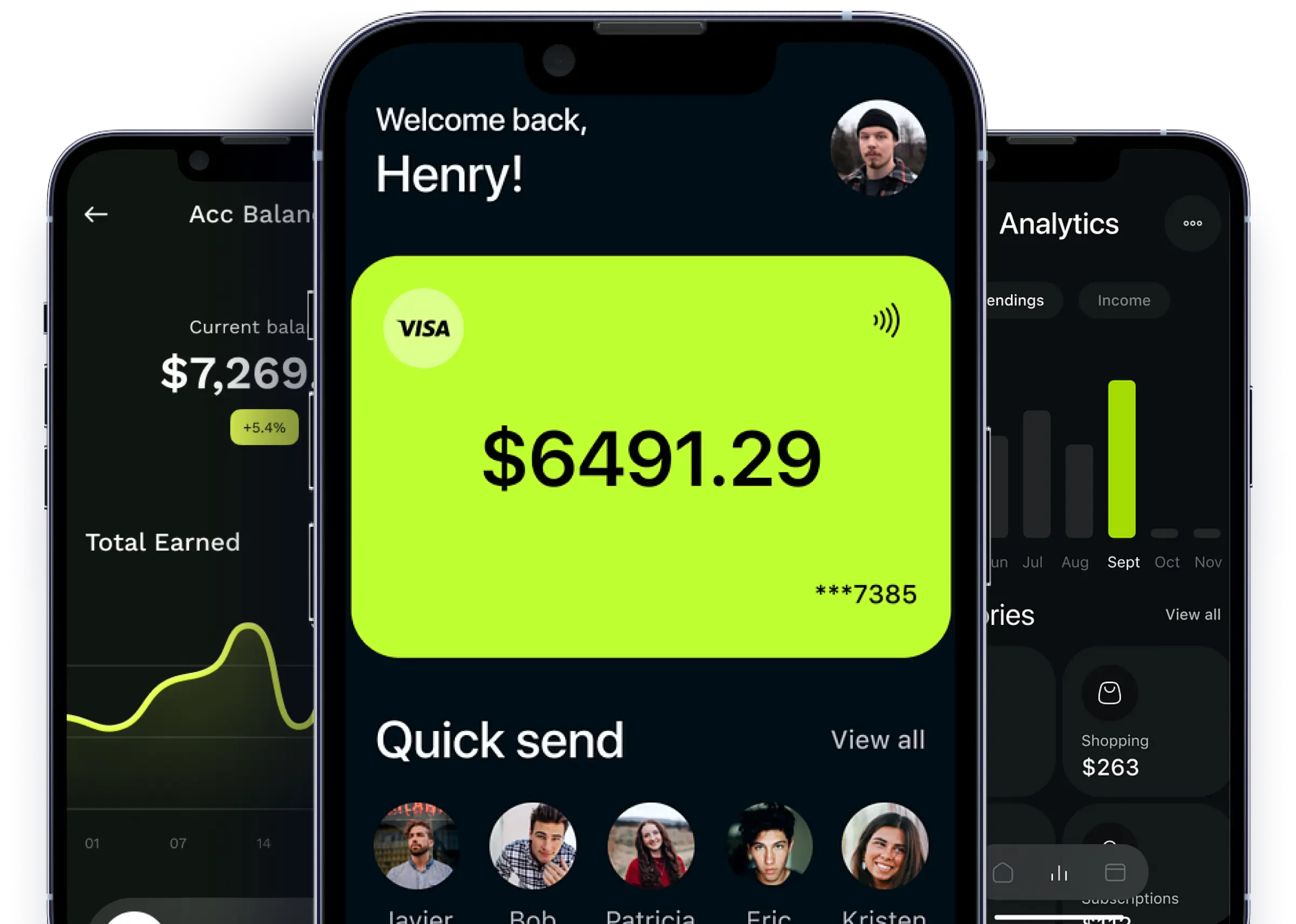

Simplify your payment process with instant and secure solutions.

Key Features of Payment Switching

Multi-Channel Support: Handles transactions from various channels, including in-store, online, and mobile payments.

Real-Time Processing: Enables instant authorization and settlement of transactions, enhancing customer satisfaction.

Secure Transactions: Incorporates advanced encryption and fraud detection mechanisms to protect sensitive data.

Integration Flexibility: Easily integrates with existing banking systems, payment gateways, and merchant applications.

Comprehensive Reporting: Detailed transaction data and analytics for better financial management.

Why Choose Our Payment Switching Solutions?

Robust Infrastructure: Reliable and secure systems that ensure smooth payment processing.

Custom Solutions: Tailored payment switching services to meet the specific needs of your business.

24/7 Support: Dedicated customer support for troubleshooting and assistance with payment-related issues.

Advanced Security: State-of-the-art security measures to protect against fraud and data breaches.

Real-Time Analytics: Access to transaction data and insights for informed decision-making.